Many entrepreneurs are INTIMATED about the Import Tax from China to the US. But honestly, calculating and minimizing it is easy. Most of the importers face lots of issues while importing products from China. You just need the right information.

Shipping from China is my forte. So, I listed useful tips on importing taxes from China and the Us. Start IMPORTING without worrying about tax penalties!

Keep reading to MINIMIZE your shipping expenses!

Now, the question arises, how much tax and duty you have to pay on your products? It is not that difficult. Even you can calculate the amount by yourself if you know your tariff number.

This calculation is a rough idea, not the exact amount. So before importing, you must know your tariff number first.

In this article, you will understand the tax, and duties on the products, imports from China to the USA.

The USA increased the tariff on Chinese products by 25% since June 2018. As a result, the cost of American consumers has also increased.

These changes have left a negative impact on those companies that import goods from China Let’s get to the details about the Import duty from China to US;

What Is Customs Duty?

When you import or export something from outside the country, you have to pay some tax on those goods. That amount is known as customs duty. The amount must be paid; otherwise, the imports and exports are considered illegal.

These duties are calculated based on the number of products.

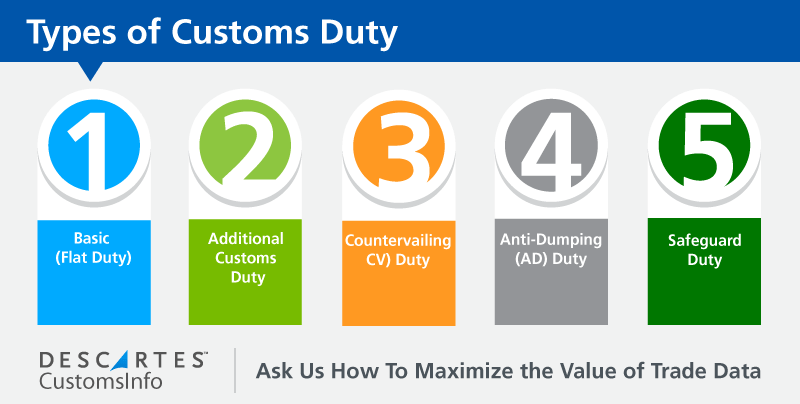

When the companies import products from China, they have to pay the following taxes:

- VAT (Value Added Tax)

- Consumption Tax

- Customs Duty

Which Type Of Import Tax Do You Need To Pay For Imports From China To US?

The import tax is charged according to the product value. I’ve witnessed China’s importation taxes change drastically over my freight forwarding career. Due to the high trading tensions between China and the USA, the tariff has gone up to 25% extra on imported Chinese products.

The list of import tax on some products is given below:

- Tablet PC: 0%

- Solar Panels: 0%

- Electric Bikes: 0%

- Furniture Products: 1%

- LED Bulb Lights: 3.9%

- Wrist Watches: 9.8% + US$1.53 per unit

- Clothing: 16.5%

- Peanuts: 131.8%

These are the import tax rates of the most imported goods from China.

How Much Customs Duty Will You Pay?

The amount that you pay as customs duty from China to US depends on the value of the product. According to the USA customs policy, goods that are under $800 are free from customs duty.

That means you do not need to pay any tax for smaller products, valued up to $800. But the tax is mandatory on the products that are above $800. The amount of tax depends on the products category according to the H.S. code.

You can check the tax rates of any category by visiting the official website of USA customs.

The customs duty also depends on the number of imported products. Customs Authorities have divided these shipments into two parts:

- Formal Entry

- Informal Entry

Formal Entry:

If you import something from China, and its value is more than $2500, then it should be covered by a surety bond to get clearance from the customs authority.

These kinds of imports are called Formal Entries. Customs authority will consider this import as commercial because the value of goods is high.

If you have already submitted the Customs entry bonds to the CBP (Customs and Border Protection), then you can receive your shipment even before paying your duties, taxes, and fees.

Informal Entry:

Those products that are valued less than $2,500 are known as Informal Entries. There is no need to cover these products by a surety bond or entry bond.

Generally, those products are counted as an informal entry, which is less than $2,500. But there are some conditions as well.

You should confirm the conditions for your products when you are receiving your shipment from the port. For example, most of the textile imports are considered to be informal entries.

But if they are valued over $250 or more, then they will be declared as Formal Entries.

According to Section 321, duty-free transport of goods is allowed if it valued up to $200. It is considered only when a specific type of informal entry is imported.

For example, if you have bought a pair of shoes from Mexico in $150, you walk across the border to pick it up, then it will be no customs duty applied on this pair of shoes.

How Do You Calculate U.S. Import Duty From China?

If you want to calculate the U.S. import duty from china, you need to check the H.S. code of those products which you are importing. Every HS code has its duty rate, and you have to pay the amount according to it.

I want to make this process easier for you. So, here are the steps we follow at AsianDavinci.when calculating the US import duty from China.

Step 1:

What’s H.S Code And How To Check It?

Now, you are going to learn what H.S. code is and how to check it.

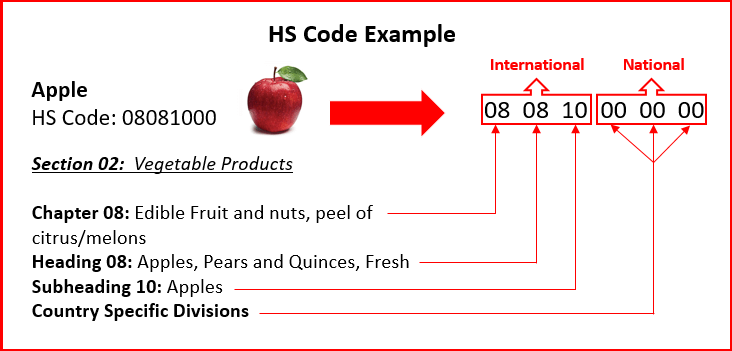

What is H.S. code?

H.S. code stands for Harmonized System Code. It is a multipurpose global product nomenclature created by WCO (World Customs Organization). It is used to find the category of products that you are importing.

How to check H.S. code?

To check the H.S. code of the product, you have to go to the official website of HTS and write the query in the search box. Then you will get the results.

It consists of the following structure:

- Six digit identification code

- 5000 commodity groups

- 99 chapters

- Each chapter has 21 sections

- Arranged in a logical structure

- Well-defined rules for uniform classification

Step 2:

How To Check Import Duty Rate Online:

There are various websites available that can be used to check the Import duty rate online. But there is an official website of HTS, where you can use the name of the product to find the H.S. Code of the product and to check the import duty rate.

Step 3:

How To Calculate The Import Tax:

If you import something from China to USA and want to calculate the import tax, you need to check the H.S. code or HTS or commodity code (these are all the same) of that particular product.

Then apply the import duty rate for that code. This tax will apply to that item without shipping.

Step 4:

If Your Product Is Hit With Another 25% Duty Rate:

If your imported product is hit with another 25% duty rate, then the prices of American products will go high. Those importers who are affected with this tariff have three options:

- Absorb the extra expenditures

- Increase the costs for consumers

- Move the production to another country

How To Pay Import Tax?

If your custom duty is pending, then you must clear your dues before the conclusion of your CBP processing.

Here are the different ways we’ve paid import taxes for our clients’ packages:

- Pay in U.S currency

- If the amount of duty does not exceed by $50, then you can pay with a traveler’s check, government check, or money order.

- You can pay with a personal check with the exact amount that can be withdrawn from the U.S bank. Moreover, you must provide identification such as U.S driving license, Passport, or id. If you attach the endorsement from another person, CBP will not accept that check.

Customs Clearance Procedures In The U.S.

When your shipments arrive, you need to be there with the relative documents. Submit those documents to U.S Customs and Border protection as soon as possible because you need to clear your cargo within the 15 calendar days of your shipment.

If you failed to do this, your products would be transferred to the warehouse. You will have to pay the extra charges of the storage as well.

You have six months after the arrival of your shipment to clear the dues. Otherwise, these products will be sold in the auction.

The clearance of the Customs charges is a bit difficult. Here are the documents you need to clear your dues. Based on experience, preparing them earlier than later is always better.

- Bill of Lading: It is an important document to make sure that the exporter has received the payment, and the importer has his products. It is receipt of cargo for the shipment issued by the carrier.

- Commercial Invoice: It is a list on which all the details about shipment and products are mentioned. CBP Collects the Custom charges based on this document.

It includes the following information:

- Product Description

- Quantity

- Country of Origin

- Destination address in the U.S.

- Tariff Classification

- Name and address company selling these Products

- Value of goods in both currencies (currencies of importer and exporter)

- Packing List: This list holds all the information regarding the invoice and packaging details of the product. Customs used this list to verify the shipment.

- Arrival Notice:This document is issued by Cargo carrier to inform you that your shipment has arrived.

- Surety Bond: You have to make sure that the payments such as duties, taxes, or import fees are clear, the importer must submit a bond to the customs authorities.This bond can be purchased from any surety company from the USA, or you can hire a customs broker.

Customs bonds are of two types:

- Annual Bond: As the name of this bond shows, this bond is suitable and most common, because it can be used for all the imports for one year. If you buy a bond that covers the amount of $50,000.00 USD, it will cost you between $400.00 – $450.00.If you want to extend your smaller bond, you can purchase the larger one as well.

- Single-Entry Bond: If you are an importer and import very few shipments in the year, like 5-10 per year, then this bond will be convenient for you. It will cost you just 5% of the shipment value.

Import Precautions (Goods From China):

There are some precautions that you need to keep in mind before importing any product from China.

- For heavier products, customs will demand the wooden packaging and fumigation certificate as well.

- If you don’t have any wooden packaging in your shipment, you just have to write “Non- Wood Packaging” on purchasing documents.

- The recommended weight for a single container of the cargo is 38,000 pounds. If the weight exceeds from limit, then it will be roped in with a particular triangle or four-corner car frames.

- “Made in China,” marker should be enforced on the product. If there is no label present on the product, the customs will demand the label.

- If you have a shipment of food products or supplements, then before customs, they will be evaluated by the FDA. Customs agencies also add the service fees of the FDA, so prepare for it.

AMS IC And VSSL ARRIVAL:

On the day of shipment at the destination port, VSSL ARRIVAL notifies the customs. It will not be counted when the last port arrived. The actual arrival port only calculates it.

AMS is a system that automatically displays the I.C. and indicates that customs has given the clearance. It shows all the customs clearance results even before the arrival of shipment.

Customs Fines:

The customs will charge fine if you do not pay your customs duties on time. Customs duties vary by country of origin and product type. You must pick your shipment within 15 working days. If no one responds within these given days, your delivery will be moved to the supervision warehouse, unloading for inspection.

Customs clearance must be needed to get your shipment clear from the supervision number. After that, if your cargo enters the warehouse for storage, then the following duties will be implemented on your delivery.

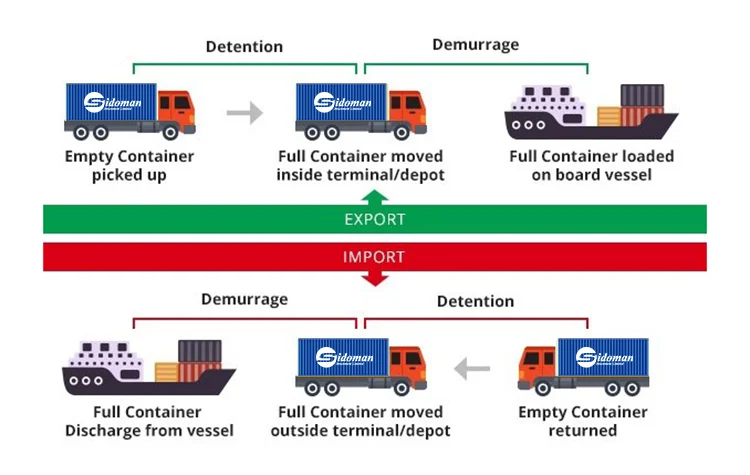

- Demurrage fee

- The cabinet fee and returning cabinet fee

- Warehouse decommissioning fee

- Warehouse loading fee

- Warehouse storage fee

- Container costs

You have six months to pay all the dues, get clearance from customs, and get the LIEN notice to pick up your shipment.

Otherwise, the customs authorities will take all the goods in their custody, and an auction will be held to compensate for the storage costs.

Free Storage Period For Docks:

Free time for storage depends on the contract. You must check yours to get the idea of how much free storage period you have on the docks.

Usually, 4 to 5 days are given for free storage. After that, you will be charged daily according to fee until you pick your cargo from docks.

Demurrage Fees:

Generally, the demurrage fee for one day range from $75 to $150 per container. But this scenario is only for five days. After that, the tax increases every day until you pull your cargo from docks.

The terminal will collect the storage fee from the shipping company if they owe the responsibility according to the agreement. The terminal will charge the extractor if the cargo carrier decline to bear the expense.

The Operation Process Of The U.S. Agent Import Goods:

- After receiving the file of the agent (should include: 1+ B/L, M B/L COPY + D/C NOTE), you need to enter the details.

- The U.S. agent must request for the arrival of goods to SSL or CO-LO, one week before the shipment.

- So because of this effort, the port O.P. must write the shipment date on the D/C NOTICE. With this help, the U.S. agent can check the arrival date in time.

- When you receive the arrival notification from SSL or CO-LO, enter the details on the computer and send it to the customs broker.

- After getting the original receipt of lading from customs broker, immediately send it to the SSL or CO-LO through courier.

- When SSL receives your fee and freight bill, they will enter the details on the computer to release the products.

- If SSL sent it to CO-LOADER, they will repeat the process and then submit again to SSL. That’s why; the delivery from CO-LO can take more than one day.

- After FAX to C/, track the route of the shipment even when going inland.

- When delivery is complete, send the delivery order to the truck company, and until conformation, contact the harvest warehouse.

- At the time of delivery, the SOC tracking box is required for sign-in conformation. After that, it returns to the designation yard.

How To Avoid Or Reduce The Import Tax From China?

Every importer wants to save money by avoiding or reducing the import tax from China. It doesn’t depend on the purchasing quantity.

Either you are purchasing a significant amount of product or just a small quantity; you will look for every possible way to save your money.

For some small importers, an import tax sometimes becomes a huge load, and they are not in the position to bear it. So, they look for every possible way to get rid of that amount.

Below are some of our go-to ways to get you free from import taxes:

3 Methods Not To Pay For Duties:

I usually don’t recommend using these methods because there are lots of risks and dangers involved in these ways.

However, some people are desperate to save money at any cost. So, here are some of my best tips to reduce import duty on your next shipment.

· Personal Exemption:

There is a duty-free or personal exemption offered by the CBP for the importers. According to this offer, the importer can bring back the total value of the products to the USA without paying any tax or duty.

CBP offers $800 personal exemption in most cases. They also have limits on some products as well.

For example, you can bring a limited amount of cigarettes, cigars, alcohol, beverages, and other tobacco products without paying duty charges.

If you are importing a small number of goods, then you will have some benefit from this offer.

· Samples:

Another duty-free exemption is a sample. Samples are the products that are only available for your waiver. You cannot sell a sample as a commercial product.

If you want to save yourself from customs duties, then you should ask your supplier to give you a sample in $1 as token price.

On your sample invoice, “Sample for No Commercial Value” must be mentioned so that you can get relaxation on customs duty.

· Dropshipping:

It is a method in which a retailer transfers the customer’s order and shipment details to the manufacturer instead of keeping the products in stock. It is also called supply chain management.

The retailer also has an option to send these products to another retailer or wholesaler.

Every retailer has different charges according to the goods. But sometimes they agreed to the fixed commission as well.

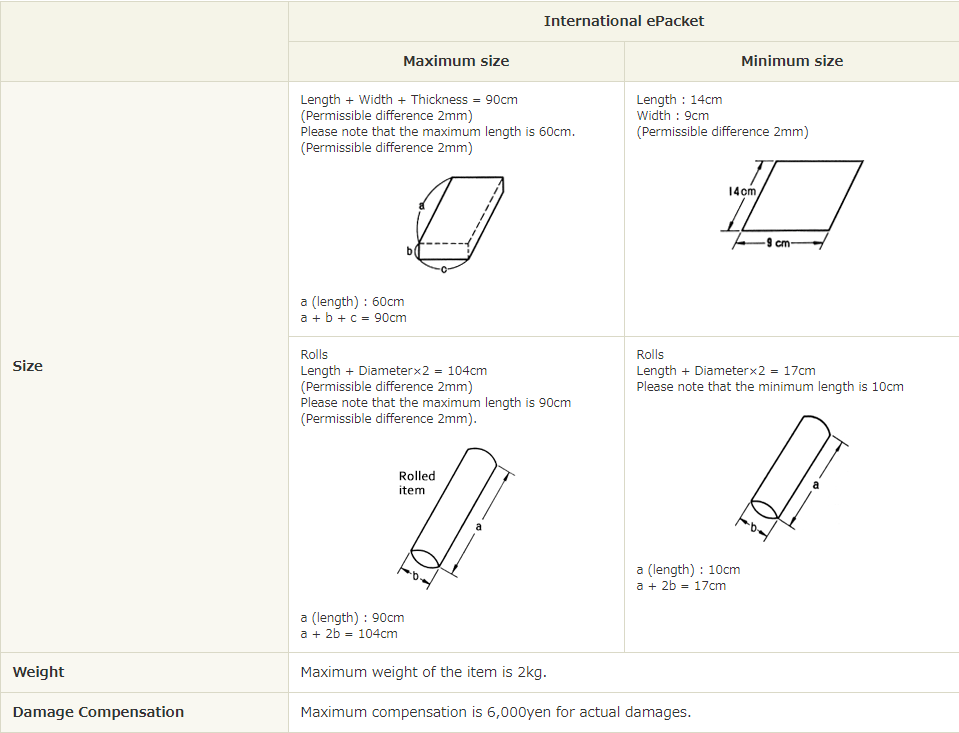

In this business, the products are directly delivered to the customer from the third party by ePacket or China Postal Parcel.

There will be no import duty on these products, but income tax and sales tax has to be paid.

3 Ways To Reduce Import Duty (Attention!):

We recommend you not to use these methods because there are lots of risks and dangers involve in these ways.

However, some people are desperate to save money at any cost by using the following methods.

· Lowering product value on the commercial invoice:

Customs have the formula to calculate the duties on imports according to the rates of products. In this method, you can reduce the import duty by lowering the declared value of your goods.

Some suppliers agree to help the importers to reduce customs duty. They lower the product value just to show the customs.

But, if the customs department of the United States finds out that the original value of the goods is higher than the declared value, they will take serious action.

If the rates are lowered on purpose, the customs will impose a hefty fine and even worse than that. They might return your goods to the landing port or may destroy them.

· Separating The Delivery Into Several Batches By International Mail:

If you import something from China, and the value of the goods is more than $2,500, Formal Entry will be required.

To make this Informal Entry, some importers ask their suppliers to send the cargo through IPS (International Postal System). They want their delivery in multiple consignments, and each should be less than $800.

Maybe you are thinking of getting the personal exemption. But you should keep this in mind that personal exemption is only allowed when you are accompanying your goods.

If you get caught by the U.S customs, and they find out that you are trying to reduce the customs duty, they will not allow any exemption for you. The other disadvantage of this method is that you have to bear the high shipping cost.

· Through Intermediate Trade Or Entrepot Trade:

Recently, from the USA government, the additional 25% tariff has been implemented on the imports from China.

This extra tariff affected the lots of importers because the additional 25% is the extra burden on their budget.

They have found a solution to this problem. Importers transit their cargo to the third country from China, then export to the USA.

Instead of China, they show that third country as the supplier country. This trick helps them to get rid of that extra 25% tariff charges. But as you use this method, there are lots of dangers and risks involved in this method.

There is a chance that your cargo may be misplaced, and obviously, the transition cost gets higher as well.

How AsianDavinci Help You Import From China:

AsianDavinci is a sourcing company located in China. They offer their services to find the required product in china.

They provide the following import services from China:

- FBA Sourcing Services

- FBA Prep Services

- FBA Logistics

FBA Sourcing Services:

AsianDavinci is a sourcing company, and its office is located in china. They are providing their services for many years in shipping, sourcing, and preparing the goods to Amazon FBA warehouses.

is working with the professional Amazon seller for ten years.

FBA Prep Services:

If you are already importing the products from China, then AsianDavinci will boost up the process by providing you its FBA Prep Services.

These steps are involved in the FBA Prep Services:

- Product Inspection

- Product Labeling

- Package Option

- Product Inspection:

AsianDavinci has a professional team that works tirelessly for the careful inspection of your goods.

This company has the advantage that if your products are damaged, they can quickly return and replace them without any issue and extra postal charges.

You can do this process in the USA as well, but there will be lots of hassles and problems that may happen.

They offer low prices which attract more importers to use their services. They send the inspected products to the FBA warehouse in the USA.

- Product Labeling:

AsianDavinci also offers its labeling services to your products at low prices. You just need to send the FBA approved label for your product, and they will complete your order within the given time.

After successful labeling, they will pack all your products and send them to the FBA warehouse for delivery.

- Packaging Options:

The packaging is also one of the services that they provide for importers. They offer different layout designs for your cargo to keep it safe from getting damaged.

For example, EVA foam for the safety of your products, if you want to create a new box for your shipment, they will design the fabric bags as well.

FBA Logistics:

AsianDavinci helps importers in shipping by giving them its Logistic Services. They will provide their services if you want any document such as destination documents, certification, or customs clearance regulations.

They offer their delivery services according to your desire. They will send the cargo through FBA Logistics Air-Delivery in case of fast delivery.

But if you desire the slow shipment, they will carry your cargo through their FBA Logistics Ocean-Delivery.

You will be charged according to the rates of delivery service you have chosen. If you hire the AsianDavinci agent for your shipment order, he will make the job easy for you.

He is responsible for the loading of your shipment, clearance of your purchase from Chinese Customs, shipping, clearance of your cargo from U.S customs, unloading, and sending your shipment to the Amazon warehouse.

AsianDavinci is fast and cost-effective with its brilliant services. If you want to import something from China, this is the company that you should be using.

Conclusion

After reading all the information and details above, you might feel that all the import process is so tricky and complicated.

However, hiring a sourcing agent or customs broker can make the shipping process complete without any trouble. You have the option to hire the service of a local customs broker to help you arrange the necessary documents.

These agents are professional and well-trained individuals and have a good understanding of the import procedure. They will charge you according to their services. The customs broker licensed by CBP can be an incredible asset when importing goods from China. And also a customs broker can help reduce import costs. Import Costs From China: Duties, Taxes and Other Fees.

In the end, when importing from China, a few points should be kept in mind. You need to confirm that all products are properly declared with CBP. So, you don’t get into any trouble with customs authorities.

If you import something from China to US, you need to pay tax for hassle-free shipment. When you receive the documentation of your delivery from the seller, you must submit those documents to the customs authorities.

If you do this promptly, you can save yourself from fines, penalties, and late fillings.

Paying the import duty and tax at the right time can save you from penalization. So, hire any customs broker or a sourcing agent to make this process smooth and quick.