What are Incoterms, and what do they mean?

Incoterms are a set of generally accepted phrases produced by the International Business Group (ICC) that define the fundamental components of freight forwarding.

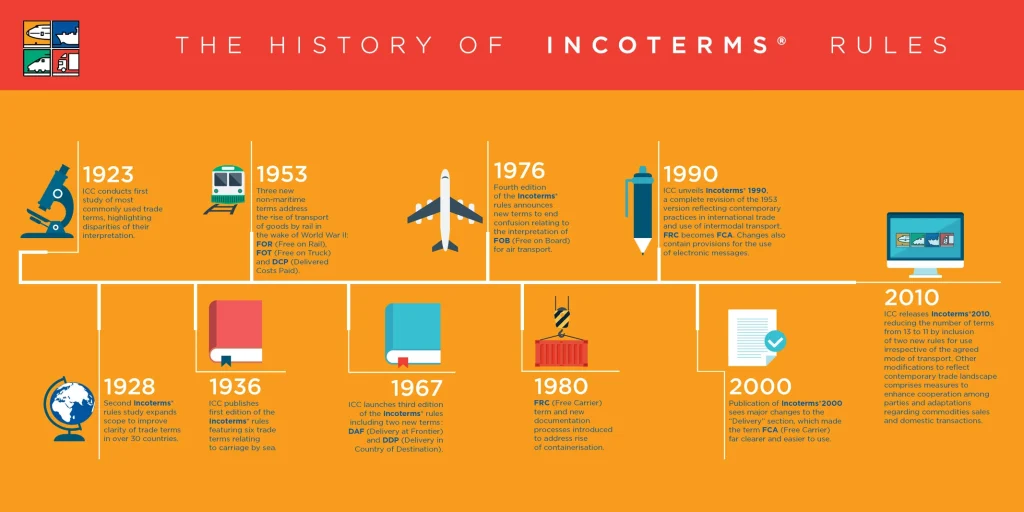

The ICC initially created the International Commerce Terminology (INCO Terms) in 1936, and we’ve summarized the 11 Incoterms that the ICC Incoterms Drafting Committee recently amended.

Incoterms® are extremely relevant to the world of world commerce.

In 2025, it will be critical for buyers and sellers to grasp Incoterms® 2010 and Incoterms® 2020, as well as each party’s responsibilities across the supply chain.

We’ll talk about why Incoterms in 2025 is significant and what “Incoterms®” means on this blog.

Chapter 1: What are Incoterms®? What does “Incoterms®” stand for?

1) What are Incoterms?

Incoterms, also known as international commercial terms, are the standard terms used in sales contracts when goods are imported or exported.

These terms clarify who is responsible for the goods during shipment and define when the responsibility shifts from the supplier to the buyer. they also specify who is liable to pay the costs of goods and their transportation fee.

2) How Incoterms Impact Your Shipping Cost

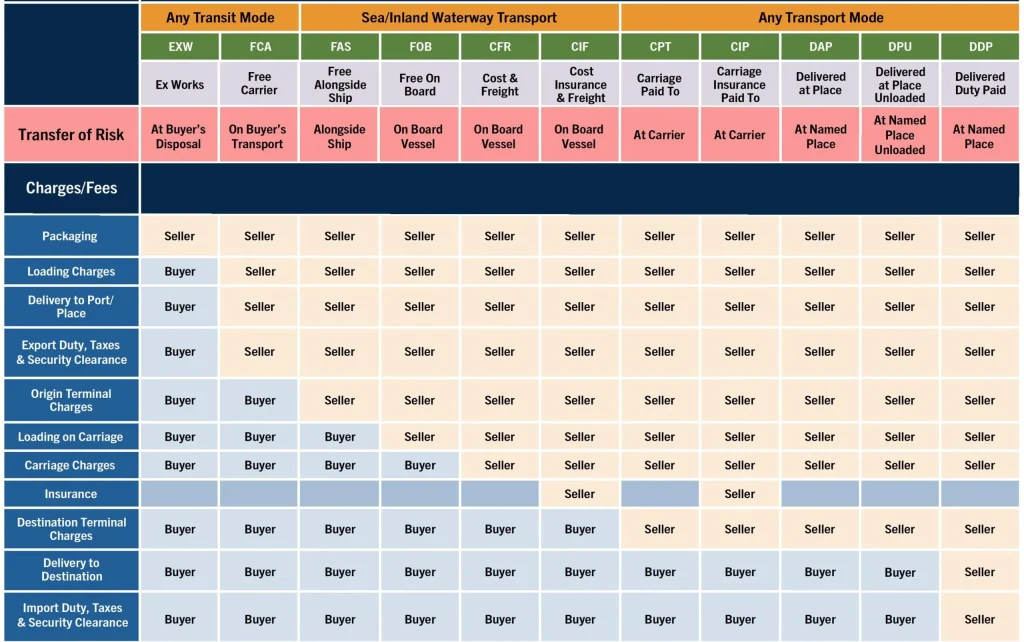

Incoterms greatly impact shipping costs because they determine who is responsible for paying at different points during the shipping process.

Let’s understand this with an example. Suppose you choose the FOB (Free on Board) term when importing goods from a supplier.

Under this term, the supplier covers the costs until the goods are loaded onto the ship.

Once the goods are on board, the responsibility for paying transportation, insurance, and delivery costs shifts from the supplier to you (the buyer).

3) 2020 Incoterms

The 2020 Incoterms are an updated set of international trade terms that specify the responsibilities of buyers and sellers at the time of shipping goods.

The purpose of this updated version is to ensure that global trade remains efficient and uninterrupted. These terms facilitate smooth international trade by offering a standardized set of rules for delivery, payment, risk transfer, and other important aspects of global transactions.

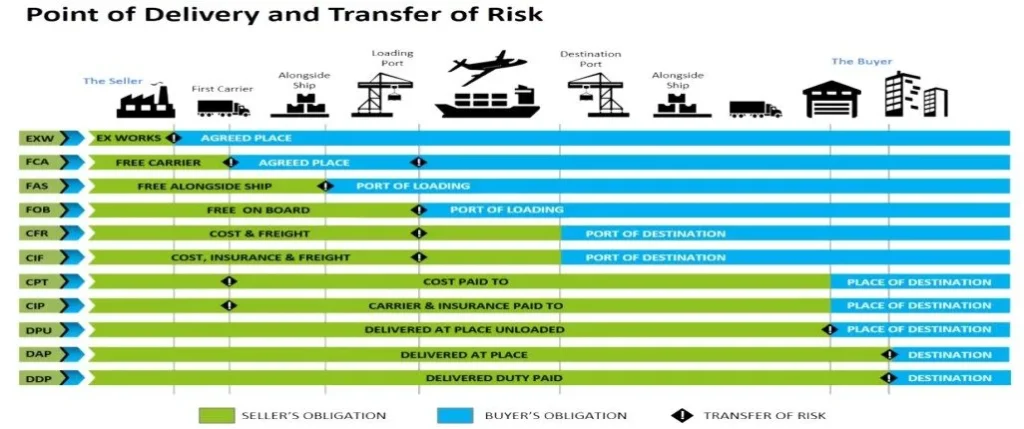

4) 2020 Incoterms Rules for Any Mode of Transport

You must choose the suitable Incoterms when shipping products. The selection of Incoterms depends on the mode of transport you choose.

If you decide to transport your goods by sea or air, you can choose from these seven Incoterms:

- EXW – Ex Works

- DAP – Delivered at Place

- DPU – Delivered at Place Unloaded

- CIP – Carriage and Insurance Paid To

- DDP – Delivered Duty Paid

- CPT – Carriage Paid To

- FCA – Free Carrier

However, if you decide to ship your goods by sea only, these four Incoterms apply specifically to ocean and inland waterway shipments:

- CFR – Cost and Freight

- FOB – Free On Board

- CIF – Cost, Insurance, and Freight

- FAS – Free Alongside Ship

5) 2010 Incoterms

The International Chamber of Commerce (ICC) updates Incoterms every ten years. The latest updated Incoterms are from 2020, and before these, there were the 2010 Incoterms.

The 2010 Incoterms, which are over a decade old, were quite similar to the recent 2020 version.

The primary reason for updating the set of Incoterms after a decade is to ensure that all shipping terms align with modern trade practices and keep up with evolving technology.

6) Using 2010 Incoterms After 2020

In general, you should opt for the most up-to-date Incoterms, which are the 2020 Incoterms. The updated terms align with current trade practices and offer more specific guidelines.

Using the 2020 Incoterms can help you prevent misunderstandings and disagreements in international trade, as they reflect modern trading conditions.

They also help you understand the responsibilities, costs, and risks involved in today’s trade.

However, there is no restriction on using the 2010 Incoterms. If you and your supplier mutually agree to use the older version, you can do so.

But it’s important to make it clear with your supplier which set of Incoterms to use, whether 2010 or 2020. It will help you avoid confusion and complexity in trade down the line.

7) 2020 Incoterms vs. 2010 Incoterms

Let’s draw a comparison between the 2020 Incoterms and the 2010 Incoterms:

a) The Shift from DAT to DPU

In the 2010 Incoterms, the term DAT specified that goods would be delivered by the supplier at the terminal only. The 2020 Incoterms introduced DPU as a replacement for DAT.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The update removes the restriction of delivering only to a terminal. It allows the buyer to get the goods shipped at any place agreed upon in the contract.

b) Insurance Responsibilities in CIP and CIF

The 2020 Incoterms offer a clearer understanding of the insurance responsibilities in CIP (Carriage and Insurance Paid To) and CIF (Cost, Insurance, and Freight).

In the 2010 Incoterms, there were no explicit details about who would obtain insurance coverage, and no set coverage limit was defined.

On the other hand, the 2020 Incoterms clearly state that the seller is required to arrange insurance coverage for the goods being shipped. However, the coverage must meet at least a minimum standard.

c) Improved Security Responsibilities in 2020 Incoterms

The 2020 Incoterms thoroughly address security-related obligations to avoid security risks in global trade. These updates define further responsibilities for buyers and sellers to ensure the safety and security of goods during transportation.

d) Using Bill of Lading with FCA in 2020 Incoterms

In the 2020 Incoterms, the FCA (Free Carrier) term can now be used with a bill of lading. This is a new change, as in the 2010 Incoterms, FCA was only used for multimodal transport.

Now, sellers and buyers can link the FCA term with a bill of lading. This update provides more convenience for both parties.

8) Why are Incoterms Important in 2025?

Incoterms hold great importance in 2025 because they clearly define shipping responsibilities for importers and exporters to avoid unexpected costs during shipping.

When you, as a buyer, choose the right incoterms with your supplier, it ensures that you and your supplier have a mutual understanding of the shipping process.

Incoterms are also essential for securing timely payments and protecting everyone involved in the trade. They become even more crucial when there are more parties and stakeholders in a trading agreement.

Chapter 2: Ten Incoterms for all modes of transport

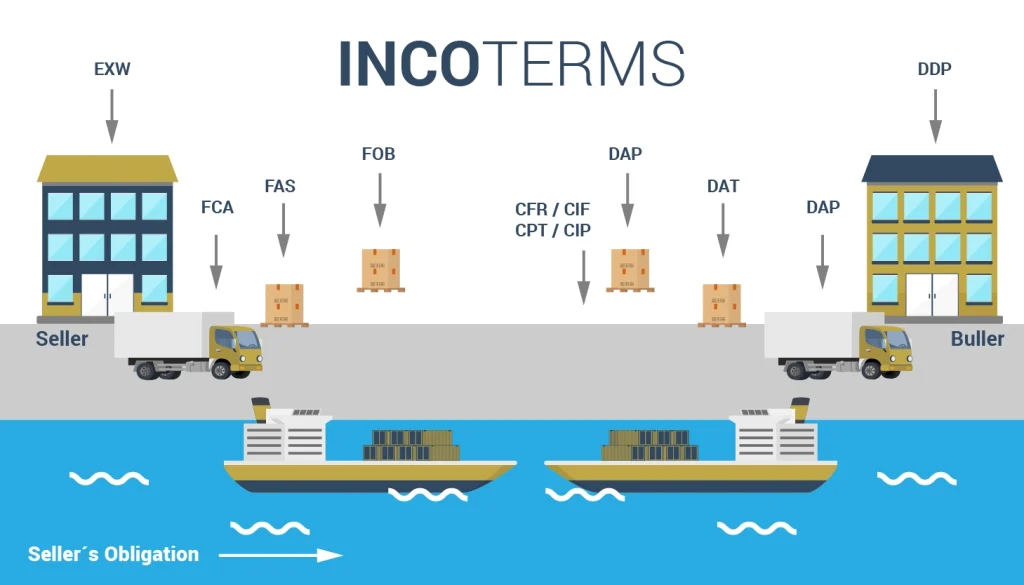

1. EXW Incoterms – Ex Works

In EXW Incoterms, the buyer is bound to transport the goods from the point of manufacturing i.e. factory to their final destination. It means that he has to pay all the loading, shipping, and export clearance charges.

During this whole process, if any of the goods get damaged, only the buyer will be solely responsible for it.

For exporting goods to other countries, EXW Incoterms is not a good option because if the buyer is not registered in any country, he cannot arrange the exports. A part of this incoterms is that the buyer has full control of the shipping of the goods.

2. FCA Intersec – Free Carrier Incoterms

FCA Incoterms provides two product delivery options.

- In the first option, the seller tells the delivery location to the buyer. The delivery is made at that location when the transport provided by the buyer, is loaded with the goods.

- In the second delivery option, sellers clear the transport that the buyer has provided for delivering the goods to the told destination.

In both these delivery options, all the charges and damages to the goods during delivery are borne by the buyer.

Once the goods are on board, the buyer needs to give the bill of lading (BOL) to the seller.

It is usually recommended for the containerized freight to opt for FCA because here the commodities go directly to the port mentioned by the buyer, from the seller’s warehouses.

3. CPT Incoterms – Carriage Paid To Incoterms

Under the rules of Incoterms, the CPT transactions involve multiple carriers. The seller is responsible only to hand over the goods to the first carrier that is cleared for export.

The chosen first carrier pays for the transfer of the commodity to the named port. From then onwards, the risk of damage or any other loss is transferred to the buyer. Arranging the freight is the seller’s responsibility only not of the shipment of the goods to the destination.

You might have noticed that on commodities, CPT and the final destination are written for instance “CPT Nepal”.

4. DDP (Delivered Duty Paid) Incoterms

Under the rules of Incoterms, the maximum risk and the responsibility of the commodities are put by DDP on the seller’s shoulders.

Export clearance, all the delivery charges, bearing the cost of damages, unloading the commodities at the named destination, import clearance and payment, and bringing the commodities to the destination, all is the seller’s responsibility.

It is the only rule that places import clearance and duty on the seller’s shoulders.

Furthermore, once the goods reach the destination, the risk transfers to the buyer. But some countries have prohibited this rule because only the registered local business firms can pay some taxes like VAT.

They do not have any process for sellers to pay the taxes.

5. C&F stands for Cost and Freight

Under the light of Incoterms CFR rules, the seller is responsible for exporting goods, pre-carriage, delivering the commodities on board at the point of departure, loading alongside the vessel, and paying the transportation cost of the commodities to the named port of destination.

When the sellers deliver the goods on board the ship, the risk passes from the seller to the buyer. From the port of destination onwards, all the fees are paid by the seller, for instance, import duties and clearance.

CFR is used only for two types of transport i.e. ocean transport and inland waterway transport. In the case of containerized freight and the freight is delivered at the terminal only, CPT is a preferable choice.

6. Cost, Insurance, and Freight (CIF)

Under the CIF Incoterms, the seller is responsible for delivering the goods to the buyer on board the vessel. The goods have to be cleared for export to the named port or terminal.

Once the commodities are on board, the buyer has to bear all the damage or risk of loss. However, it is the responsibility of the seller to buy the cargo insurance for the named port.

CIF is a good option for such conditions where different transportation modes are used. For instance, when the goods or the products are delivered to a carrier at a container terminal.

7. Free on Board (FOB)

Under FOB, the buyer nominates a vessel, and the commodities are delivered to the buyer on it at a seaport or wharf that has been already selected as the place of shipment. Up to this point, the seller bears all the costs and from here onwards it becomes the buyer’s responsibility.

Under FOB, the price of freight equals the sum of the factory price and FOB local charge.

Also read on; What does FOB mean? Read to Know More

8. Carriage & Insurance Paid (CIP) To Incoterms

Under CIP Incoterms rule, the supplier, after export clearance, delivers the commodities to its own chosen carrier. The first carrier pays for moving the commodities to the named port. From this point onwards, the buyer will bear the risk of loss or damage.

However, the supplier buys the cargo insurance for the named port. Like CIF, CIP also requires cargo insurance. It requires the supplier/seller to ensure that the maximum cargo insurance complies with Institute Cargo Clause (ICC). The Institute of London Underwriters introduced these clauses in the early 1980s.

They are a part of the UK Marine Insurance policy.

9. Incoterms DPU – Delivered at Specified Location, Unloaded

Under DPU Incoterms rule, the merchant delivers the commodity to the place of destination. Once unloaded from the arriving transport, the goods are now at the buyer’s disposal.

The merchant has to pay for any loss or damages during the transport and unloading of the goods at the named port.

DPU Incoterm is important in a way that only it bounds the seller to pay for unloading as well. No other rules have this clause.

DPU replaced one of the 2010 Incoterm, DAT, because it was confusing, debatable, and the language used in it was also weak. The seller could deliver the commodities at any location that is considered a “terminal” under DAT.

But in DPU, the seller cannot do this. He has to deliver the goods at the terminal chosen by the purchaser itself and is also responsible to pay for damages during transport and unloading of the goods.

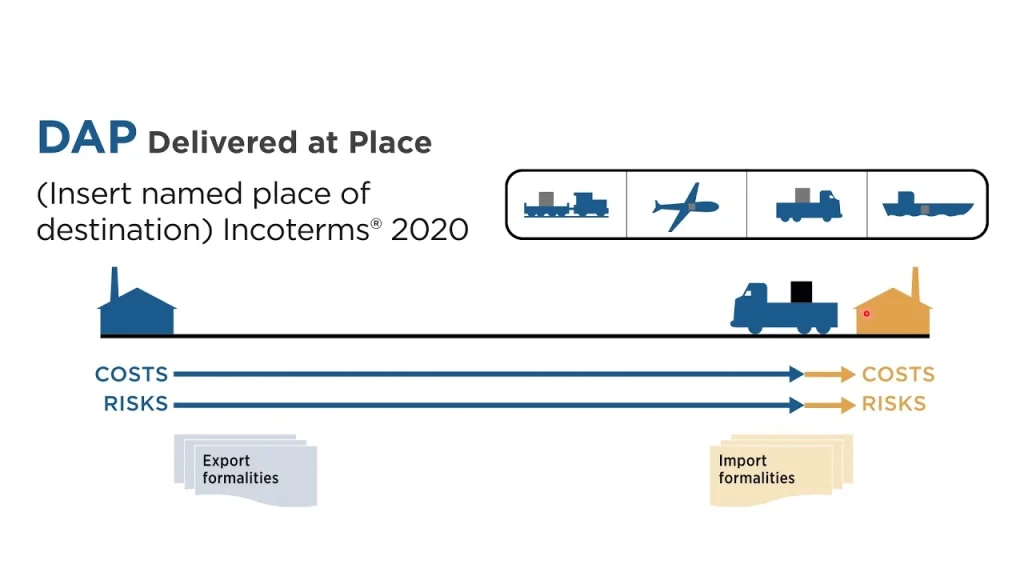

10. DAP (Delivered at Place) Incoterms

DAP Incoterms makes the supplier responsible for arranging for transport and delivering the commodities to the chosen point of destination.

Unloading is now the buyer’s responsibility unlike DPU where bearing the loss during unloading is the seller’s responsibility.

Chapter 3: Four Incoterms for Ocean Freight Usage

1. FAS Incoterms – Free Alongside Ship

In FAS Incoterms, the seller is responsible for the export clearance of the goods. He places the goods alongside the export vessel at the port.

The location of the port is chosen by the buyer. Loading, handling local carriage, import duties, and delivery to the final location is the responsibility of the buyer.

FAS Incoterms are applicable on transport via ocean or inland waterway with massive cargo like oil or grain.

FAS impose certain responsibilities on both, the seller as well as the buyer. These are discussed below:

| Seller’s Responsibilities | Buyer’s Responsibilities |

|---|---|

| Products, commercial invoices, and documentationPackaging of export products and their labelingCustom duties and export licensesCarrying the export goods to the terminalDelivering the products at the port for shipmentEvidence of timely deliveryThe seller has to pay for the inspection of products before delivery | The buyer has to pay for the goods as per the sales contractLoading cost of the goods on the shipment vesselThe main location to take the export goodsDischarge of the goods and further delivery to the destinationAll the import duties and documentationThe cost buyer pays for import clearance |

2. FOB Incoterms – Free On Board

FOB Incoterms apply to all the modes of transport, including the transport through the ocean. As aforementioned a place of shipment, usually, a seaport is already selected.

The seller delivers the merchandise to the buyer on a transport vessel that has already been chosen by the buyer at the selected port.

From the port onwards, all the risk of loss or damage and other payables are the buyer’s responsibility. They have to bear all the expenses. The sellers are now not responsible for any kind of payments, duties, or taxes.

One more thing is that the cost of freight, under FOB is the total of the business unit price and FOB local fee.

Below is a list of sellers’ and buyers’ responsibilities in FOB Incoterms.

| Buyer’s responsibilities | Column 2 |

|---|---|

| Payment on all the charges from the shipment of cargo from the port to the final destinationSome buyers, for their shipment, purchase insurance. It is not a requirement under FOB but just a choice.Just like sellers pay for OTHC, the buyers have to pay for destination terminal handling charges (DTHC).The buyer has to pay for the delivery of cargo to the destinationHe has to bear the expenses of unloading the goods at warehouses.All the taxes andfees regarding the customs clearance are the buyer’s headache. In case of delays or penalties, only the buyer has to look after the charges and risks related to it. | Packaging of the export commodities to ensure safe shipping.A seller has to pay for loading the commodities at the warehouses.The seller has to pay for transporting the cargo from the warehouse to the point of shipping i.e. seaport.It is the seller’s responsibility to ensure the export clearance of the cargo and to pay all the required taxes.The cost of loading the commodities on the carriage is the seller’s responsibility.The seller has to pay origin terminal handling charges (OTHC). |

The origin terminal handling charges are the fees that are paid to the terminal authorities for handling the cargo during the loading and departure of the cargo.

3. CFR Incoterms – Cost and Freight

In the list of most commonly used trade terms, CFR is number second and FOB is number one. The CFR Incoterm bounds the seller to load the goods on board the vessel. He has to carry out the export clearance.

Whereas, the buyer’s responsibility starts the moment when the commodities are on board the vessel. He has to pay for the import formalities just like the seller does for the export formalities.

Let’s dig deep into the seller’s and buyer’s responsibilities in CFR Incoterms.

| Seller’s responsibilities | Buyer’s responsibilities |

|---|---|

| The sellers pay for keeping the goods in warehouses.They pay for loading the goods on the carriage and transporting them to the desired port.Payment of the deportation charges is also their responsibility.They pay for all the documents required for export.All the export customs and duties are their responsibilities.They pay for freight charges. It means they have to pay for moving the goods to the exporting nation’s port. | The buyers pay for unloading the goods at the import country’s port.From the port of unloading to the final destination in the importing country, the buyers pay for the transportation.As the commodities are loaded on board by the seller at the export country’s port, the risk of loss or damage shifts to the buyers.In CFR, the buyers pay for insurance.The buyers are responsible for preparing import documents, custom and duty clearance, and all other taxes applicable in the country of import. |

4. CIF Incoterms – Cost Insurance and Freight

It holds sellers responsible for delivering the commodities on board the vessel from the exporting country’s port to the importing country’s port. The sellers clear the goods for export.

They also pay for the minimum insurance coverage on the commodities as they are transported to the chosen port of destination.

The risk transfers to the buyers when the goods are on board the vessel for the final carriage.

There are some responsibilities that CIF Incoterms puts on both the parties i.e. the seller and the buyer. These are discussed below:

Seller’s responsibilities

- Commercial invoices and documentation are the seller’s responsibility

- The seller is responsible for packaging and marking export commodities

- The seller pays for all the export formalities.

- Pre-carriage and loading charges are paid by him.

- Delivery charges from the warehouses to the port of shipment come under the seller’s responsibilities.

- The seller has to pay pre-shipment inspection fees

- Cost of the minimum insurance coverage

Buyer’s responsibilities

- The buyer pays for all the import formalities.

- The transport of goods from the import country’s port to the final destination comes under the buyer’s responsibility.

- The cost of inspection of goods before shipment to the destination

Chapter 4: Incoterms for Air Freight Usage

Seven incoterms can be used for air freight. If you want to send goods by air choose any of the mentioned incoterms.

Well, we have already discussed three of the seven Incoterms – EX Works (EXW), Free Carrier (FCA), and Carriage Paid To (CPT) – in the previous chapter (Chapter 2). Our readers must be familiar with these terms by now.

Let’s move on to the remaining four Incoterms specifically used for air freight.

1. Carriage and Insurance Paid (CIP)

The Incoterm CIP means that the seller is in charge of arranging the delivery of goods to the carrier and covering the shipping cost to the specified destination. In this Incoterm, the seller is responsible for arranging insurance for the goods.

2. Delivered at Place (DAP)

In the Delivered at Place (DAP) Incoterm, the seller is responsible for all expenses and risks until the goods reach the buyer’s location or any other agreed-upon destination. The seller covers the main transportation costs but is not accountable for customs clearance.

3. Delivered at Place Unloaded (DPU)

The Incoterm DPU requires the seller to pay for transportation to the terminal and handle all risks until the goods are unloaded. However, the seller is not accountable for expenses related to import clearance, even if they occur during transit to the terminal.

DPU has replaced the previous term DAT (Delivered at Terminal) and now includes the seller’s responsibility for unloading the goods at the destination.

4. Delivered Duty Paid (DDP)

DDP, or Delivered Duty Paid, places most responsibilities on the seller. In this Incoterm, the seller is obliged to secure the import license for the goods and bears all costs and risks related to transportation, insurance, and customs procedures.

It encompasses handling documentation, as well as payment of duties, taxes, and customs fees.

Chapter 5: Frequently Asked Questions About “Incoterms”

Also read on: The Complete Yiwu Market Guide

The Bottom Line

Incoterms are the sets of rules formulated by the ICC. There are a number of them that are used for air, sea, and land transport of the cargo to other countries.

These rules are important in understanding international trade and the cost and risks associated with the transport of commodities. Every business owner who does trade on the international level should know all these rules.