Have you heard about customs clearance before?

Are you interested in knowing about the process of customs clearance?

Customs clearance is the act of transferring (importing or exporting) goods through customs for safely entering another country. Trade is a global way of sending and receiving goods.

Every country has different rules and regulations regarding trade; hence, variable degrees of import and export duties/taxes will be imposed on goods crossing its borders.

In this blog, we will discuss customs clearance in detail.

We will mention all the important aspects of it like, the major import and export documents needed for customs clearance.

Also, we will discuss the whole process of customs clearance and all other necessary details. So, before you decide to import or export something, give this blog a read.

- Chapter 1: A Must Know List – Understanding Customs Clearance

- Chapter 2: Essential Documents Required for Import & Export Customs Clearance

- Chapter 3: What to Do before Dealing with Customs Clearance?

- Chapter 4: Step by Step Process of Customs Clearance

- Chapter 5: 6 Tips to Ensure a Smooth Custom Clearance Process

- Chapter 6: Major Mistakes to Avoid in Custom Clearance

- Chapter 7: Frequently Asked Questions About Customs Clearance

- Conclusion

Chapter 1: A Must Know List – Understanding Customs Clearance

A necessary procedure that permits the transport of goods internationally is called customs clearance. Customs clearance can be a complex topic for you to understand as it has a lot of legal terms.

So before you get deep into the process of customs clearance, you must know the basics like what customs clearance is and when it is required, etc.

1. When is the customs clearance required?

Whenever we deal with international trading, we come across a term called customs clearance. It is the duty we pay to the government of a country for the transfer (import/export) of goods through its land.

So, customs clearance is required whenever we trade goods internationally.

2. How to calculate the customs clearance fee?

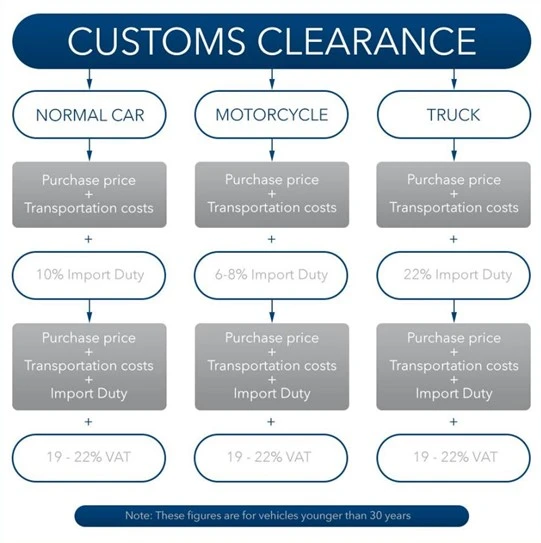

For instance, if you need to import vehicles from US to Europe, you need to follow the EU customs clearance tariffs, and the import duties can include, 22% for trucks, 10% for passenger cars, 6-8% for motorcycles.

Expect the import duties, depending on the country/region, you will pay value-added tax (VAT) of 19-22% on the import.

The total cost of customs clearance can be predicted by a few factors. You can also use different online tools available for calculation.

3. How much time a customs clearance process usually costs?

Customs clearance takes not more than one day in normal cases when everything is fine. If you have any issues regarding documentation, packing, or other such things, the process may take more than normal time.

Therefore, it is important to have all the documents in place. Moreover, proper packaging also plays an important role.

If, for any reason, the custom officer thinks that your cargo is not in place – it can be a hassle. A lot of time is consumed in unpacking, checking and repacking goods.

4. Who is responsible for customs clearance? Buyer or seller?

To make international trade easier and safe, custom clearance happens when you the goods are leaving the country and export and reach the destination country.

Generally, the seller takes the responsibility for the export custom clearance. For instance, if you are importing goods from China to USA, the Chinese supplier will take care of custom clearance from China. On the other hand, the buyer will be responsible for the import custom clearance in U.S.A.

However, not everyone can take on the custom clearance process. Mostly, the freight forwarder will take care of it or you can hire a customs broker.

5. What advantages does a customs broker provide?

You can contact a freight forwarder to provide you the service if customs broker, or you can hire a private broker also. The main advantages of hiring a customs broker are mentioned below.

- A customs broker helps you in the safe shipping of your goods because they are professional in this field.

- A customs broker keeps you updated about the costs and also lets you know the strategies to save your money.

- The customs broker will proofread the documentation and eliminate all the errors also.

- When you are importing products from another country, a customs broker who does business on both sides can ensure that your goods get to you quickly.

- Many customs brokers will provide you with additional tools or use internal systems to improve your efficiency, control your costs, and keep your products away from the risk of non-compliance.

Chapter 2: Essential Documents Required for Import & Export Customs Clearance

To pass all hurdles related to customs clearances, and import/export your goods easily, you should know about the essential documents. Otherwise, it can become very difficult and you might even loose your cargo for good.

1. Must-include documents list for import & export customs clearance

The import and export of goods cannot be done without the necessary paperwork. You need legal documents for both processes.

So, the lists of documents needed for the customs clearance at import and export terminals are given below.

| Must-include Documents for Import Customs Clearance | Must-include Documents for export Customs Clearance |

|---|---|

| Bill of entry | Pro-Forma Invoice |

| Commercial invoice | Packing List |

| RCMC Registration certificate | COO Certificate |

| BOL: Bill of Lading or Airway Bill | Commercial Invoice |

| Import license | Shipping Bill and Bill of Lading |

| Insurance certificate | Letter of Credit LC |

| Letter of credit | Bill of Sight |

| Notice of arrival | Health Certificates |

| Test Report | Warehouse Receipt |

| Technical Write-up or Literature and Industrial License(Only for special goods) | Bill of Exchange |

| DEEC/DEPB/ECGC License | Export License |

| GATT/DGFT declaration | – |

2. Main documents to help the Customs Authority to clear the products quickly

The main documents that you will need to help customs authorities clear the products quickly are discussed below.

- Export & Import License

To export goods, you must have an export license. The first international export of a shipper cannot be carried out without an export license as it is required only for the first time.

You have to first apply to the licensing authority, and afterward, the permission is granted. The chief controller of imports and exports is responsible for providing you the permit.

Import license, as the name indicates is the permission of a government grant to allow the import of goods that are restricted. For getting an import license, you have to apply to the licensing authority office.

- Pro Forma Invoice

Pro Forma Invoice is sent to the buyers before shipment once the order is confirmed. It is an agreement between all parties.

In some countries, the pro forma invoice is also used instead of a commercial invoice. Hence, it is also used to determine the import taxes and duties.

The pro forma invoice is generated according to the terms and conditions decided by both parties. So, it also includes the info about the number of goods.

- Customs Packing List

The list of all the items included in shipping is known as the customs packing list. This list can be matched with the pro forma invoice for double-checking.

It is sent with the shipment because it helps the transportation companies to keep track of the things included in the shipment. It minimizes the risk of international exporting of wrong cargo.

- Country of Origin

The COO – country of origin, is issued by the exporter. It is a declaration that ensures that the goods being shipped are manufactured, processed, or acquired from a particular country.

- Commercial Invoice

Commercial Invoices can be defined as a mandatory legal document issued by the seller of goods. It connects two parties and is used as proof of sale between them.

The commercial invoice has the following things mentioned on it:

- Volume and weight of goods

- The number and date of the invoice

- Pricing of goods being sold

- Freight insurance

- Tax identification numbers of buyers and sellers and other information.

- The incoterm buyer and seller have agreed upon

Customs forward the shipment only after accurately matching this information (commercial invoice) with the actual shipment.

- Shipping Bill

When a ship or vessel is allowed to move out of a country, it is granted a shipping bill. The bill is then physically verified by the authorities. The assessment of the value of exported goods is done through this bill.

In short, a shipping bill assists an exporter to get quick customs clearance, easy loading of goods, and beneficial claiming of duty drawbacks. So, a shipping bill is a measurable record or a report of goods and their value.

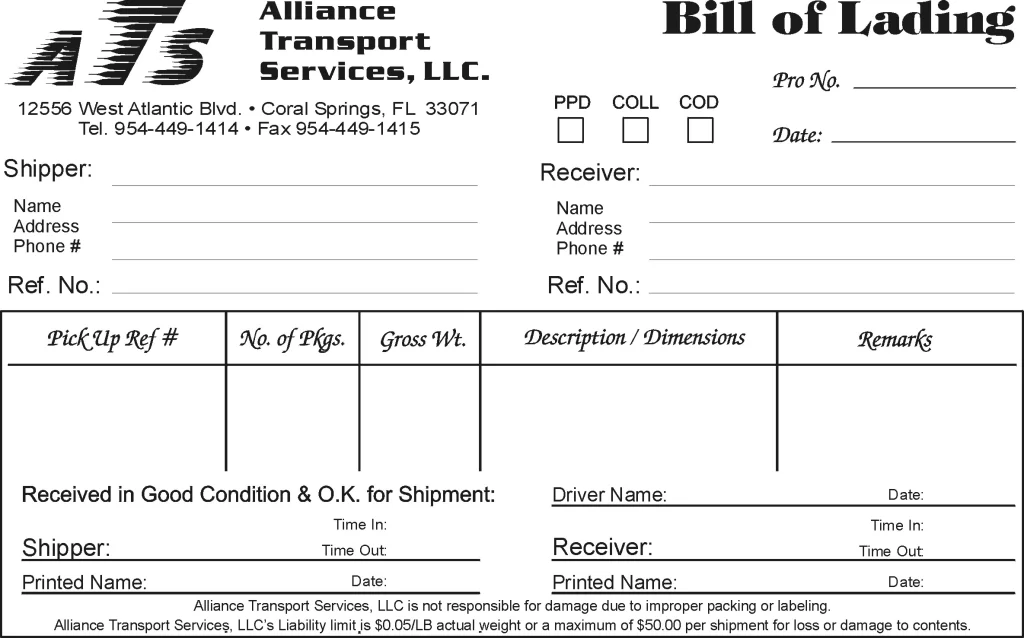

- Bill of Lading

bill of lading templates printable bill of lading template bill tracing bills of lading to sales invoices provides evidence that – Invoice Template Ideas

BOL – Bill of Lading is evidence that the importer and the exporter have entered a contract. It is a legal document issued to the shipper. You can also find product information on it.

BOL can be used as a receipt of lawful shipment at the port. You cannot proceed with international shipping if you do not have it so, it is an important document that needs to be duly signed and kept safe.

- Bill of Entry

The bill of entry is required to start the examination of goods. It is a legal document that is signed by the importer or carrier of the shipment.

It is filed with the customs department. The importer or the customs broker is responsible for filing it before the arrival of shipment.

The Customs department requires it for the clearance process.

- Customs Invoice

A customs invoice is the same as a commercial invoice. It has a specific format that was set by the customs authorities. The customs broker is responsible for supplying you with a form, and after that, you can fill out your customs invoice.

- Insurance certificate

It assists in the verification of shipment and import customs clearance and ensures that the selling price contains the insurance too. It is important for the determination of the import duty aggregate.

- GATT/DGFT declaration

While completing the customs clearance formalities, GATT/DEFT declaration is filed by all importers. You need to follow the terms of the General Agreement given below to file GATT/DEFT.

- Imported goods customs valuation

- One copy of the declaration for the declarant

- Two copies of the declaration for the customs administration

- Accurate filling of the form

Chapter 3: What to Do before Dealing with Customs Clearance?

Paying customs is not the only requirement of international trade. You have to comply with the packaging requirements, choose a customs broker, have knowledge about the trade agreement, and prepare documents.

Before getting involved in the process of customs clearance, you should have a clear understanding of few things mentioned below.

1. Picking a customs broker

A customs broker is an individual who facilitates the process of customs clearance. He makes sure that the shipment meets all the standards, rules, and regulations for the export of goods. He assists with the documentation and payment of taxes.

Before worrying about customs clearance, you need to look for a customs broker. The freight shipping companies also provide this facility. You can hire your own customs broker or take help from 3rd party also.

2. Check trade restrictions

You should know what are the restrictions related to trade. Every country has different rules and regulations, and traders are bound to comply with them.

Some things may be prohibited in one country and allowed in another. So, it is a better way to check the lists generated by the government before exporting or importing goods.

The main rule to crack the trade restrictions is to know what is prohibited and what is restricted.

You can import and export prohibited goods only if you have special permission. You are asked to fulfill certain conditions before grant of the trade permissions.

Some goods have restriction policies like:

- Age restriction

- Licensing restriction

- Quantity restriction

- Packaging restriction

You should follow all these restrictions to trade successfully.

Failing to comply with the rules can cause serious complications for you. Your cargo may get seized, and you may face legal issues and penalties.

3. Certain trade agreements

International trade cannot be completed without complying with trade agreements. These agreements are used to determine the value of duties and tariffs. Some trade agreements can help you and be advantageous, while others may cause hurdles.

However, it is a must to keep trade agreements in your mind before dealing with international trade. Some of these trade agreements are listed below.

- FTAs – Free trade agreements

- Anti-dumping trade agreements

- CVDs – Countervailing duties / anti subsidy duties

4. Verify copyrights

Trading is not merely about the export and import of products. It is a huge responsibility. You have to protect your intellectual property and stay careful about other people also.

You can not infringe anybody’s copyrights and should know the handling of intellectual property.

While exporting, you do not get the advantage of trademarks and copyright protection. If not checked, your goods may get seized at the port of another country for being counterfeit of other products.

5. Research about buyer/seller

Knowing about the other party is always a key point for a successful trade. If you are a seller, then, you should know about the buyer so well that you can trust them.

You should make sure that all the parties involved in your supply chain have been screened. Hence, you can save yourself from the restricted party.

Restricted party includes all those people who

- Have previously been identified as drug traffickers

- Is linked with terrorist organizations

- Have been involved in corrupt business practices.

Violating these conditions may lead to suspension of your trade license and also imprisonment. A safe solution to this problem is to get linked with renowned freight forwarders.

This is because they run screening programs before dealing with the shipment and also keep you updated.

6. Prepare documents

Preparation of documents is the next important step. You should keep the following important documents prepared before further advancement.

- Commercial Invoice

- COO – Certificate of Origin

- Packing List

- Letter of Credit

- Airway Bill or Bill of Lading

Other documents may include licenses and permits that help in the completion of the process. Your customs broker may also help you in this regard. He might inform you which else document you need for the clearance of customs.

7. Confirm packaging requirements

Packaging is the key to international trade. Certain rules regarding packaging have to be followed by exporters. You can only use specifically approved material for the packaging of goods.

The right packaging may save you from the torture of the hectic customs clearance process.

Not complying with the rules and regulations will cause problems. Because your cargo will be thoroughly checked in this case.

You may also need to pay for repackaging as your goods will be opened and unpacked for customs clearance in case of wrong packaging.

8. Pay attention to different kinds of invoices

While preparing for shipping paperwork you should also pay attention to the different kinds of invoices. This is necessary so that you can supply your customs broker with the correct documents. Following are the most popular invoices.

- Commercial invoice

- Pro forma invoice

- Customs invoice

9. Pre-shipping inspections

Checking the shipment before going for the actual shipping process can save you from trouble. The pre-shipment inspection helps in quality control and the order of everything. Check whether:

- You are shipping hazardless material.

- You have attached easily readable labels.

- The quality of goods is as promised.

- You have not added any restricted or prohibited product without a license.

If you think that all this is too much for you, you can contact our sourcing agent. She will be happy to guide you and help you out in choosing the right freight forwarder for your business. Book a free consultation today and leave your customs headache to us.

Chapter 4: Step by Step Process of Customs Clearance

Shipping and trading across borders are not the same as exchanging goods locally. International shipping involves the process of customs clearance. You need to know all the necessary details about it before getting into the process.

Remember, there are two types of custom clearance that the cargo goes through. Firstly, there is the export custom clearance process in which cargo will leave China. Next, there will be an import custom clearance process in the destination country.

This chapter discusses all the extra steps you will need to follow for customs clearance.

1. Examination and verification of paperwork by a customs officer in export country

When you are exporting goods, the custom clearance process is a little simpler. If all the paperwork, cargo packaging and weight of the cargo is appropriate, the custom clearance process is going to be a breeze.

The Customs officer keeps a check on the fee applied to any shipment and makes sure all the taxes and duties have been paid.

2. Assessment and payment of duties for customs clearance

The import fee is not the same for all goods. Various types of goods have various ranges of import fees. To assess the duties and taxes for customs clearance, you need to know about the de minimis value.

As the name indicates, it is the minimum value that is subjected to taxes.

For instance, if you are trading goods with a minimis value of $200, you will not be subjected to the duties unless the value of goods exceeds $200. Certain goods are subjected to taxes regardless of the de minimis value.

Another major factor in the assessment of duties and taxes is the mode of shipping i.e. the incoterm. There are different taxes for shipping through DDU (Delivery Duty Unpaid) and DDP (Delivery Duty Paid).

3. Choice of incoterm while shipping

The choice of incoterm while shipping is one of the most important decisions can make regarding international trading. In the best sceneries, you can either opt for DDU or DDP.

DDU – delivery duty unpaid as its name indicates means that the import duties and taxes have not yet been paid. In DDU, the customs broker collects the required documents from the customs officer independently.

If you involve a middleman (customs broker), then he will also charge a fee for his services. A customs broker will help you in the process of customs clearance.

DDP – Delivery duty paid means the taxes and duties are already paid. The paid amount covers all the import fees so, it is predicted that DDP offers more benefits than DDU. A brief account of all the charges is given below.

| DDU charges | DDP charges |

|---|---|

| Variable taxes | Variable taxes |

| Fee for administration of goods = $15Fee for handling of goods = variable but small | Goods inspection charges =$70Goods storage charges = $10/dayhandling charges = $10Goods insurance charges = $ 5 |

To understand the shipping incoterms in detail, it is important that you go through this blog “Incoterms 2024 Explained”

4. Actual shipping process

Shipments are held at the customs office until the complete satisfaction of the customs department. These shipments are only released when all the obligations (paperwork, taxes, and duties) get fulfilled.

The actual shipping starts once all duties get paid, and all the goods are according to the customs laws. Choosing the transport service for your goods is your responsibility.

The shipment that has paid all the duties very rarely gets stuck in the customs department.

5. Import Custom Clearance Process

Once the goods reach the country of destination, they are unloaded. Here, the custom clearance process starts again. The customs officer will check all the documents and the cargo. They will see whether all the costs have been cleared and all the documents are in place or not. If everything seems good, they will take the fee and let the goods go ahead.

Chapter 5: 6 Tips to Ensure a Smooth Custom Clearance Process

Following tips are useful for avoiding custom delay and for quick forwarding of goods from the customs office.

- Make sure you have all the documents ready so that you can quickly submit them when required.

- Make sure that the documents are correct, complete, and duly signed.

- Write the accurate value of goods so that customs officers can easily assess duty and taxes.

- Do packaging according to the requirements of the customs department.

- Clearly write a phone number so that you can be contacted easily if needed.

- Write the information about the manufacturing of the goods. Tell where they were manufactured or produced.

Chapter 6: Major Mistakes to Avoid in Custom Clearance

Undoubtedly, custom clearance is very overwhelming process. Even some of the most seasoned businessmen can get confused and exhausted while trying to get it done. In this chapter, we will be talking about the major mistakes that you should avoid while doing it.

1. Assuming Air Freight is Expensive and Waste of Money

The biggest mistake that importers make is to assume that air freight is expensive, thus, a waste of money. Nonetheless, this is not the case. Not choosing the right shipment method can be a problem in customs also.

A type of shipping method that is best for one buyer might not be suitable for someone else. The details about the shipping methods are provided in this blog.

2. Inaccurate, Incomplete or Incorrect Documentation

Usually we assume that putting in incorrect information/documentation is the reason for problems at custom clearance. However, even if you don’t put complete information, it can be worrisome.

For example, if you have not mentioned the weight of the products inside the cargo, the export custom officer will stop the products. Next, either they will ask you to provide proper documentation or will return the cargo. This will result in unnecessary delay.

3. Wrong Valuation of Goods

The value of the goods that are being imported/exported is very important. You might be wondering why is that so? This is because the custom tax and duties are determined on the value of the goods.

Sometimes, sellers try to scam the custom officers by providing underdeclaration of value. They think that doing so will result in lower duties.

However, this is risky. If you get caught, you will be fined heavily. Hence, it is a risk that is not worth taking.

4. Not Understanding Your Product’s Dynamics

The import/export business is not an easy one. The tariffs and import duties keep on changing from time of time. To understand what types of duties, taxes and tariffs will apply to your product, you need to understand your product in depth.

The easiest way to do so is to know the Harmonized Tariff Schedule (HTS code) of the product.

It is a 10-digit code which is used for imports coming into America. Moreover, the first 6 digits are recognized all over the world. After you obtain this code, you can ask your freight forwarder about the tax and duties.

Chapter 7: Frequently Asked Questions About Customs Clearance

Conclusion

Undoubtedly, custom clearance is a complex topic. Therefore, we recommend you to hire professionals to help smooth out the process. Equipped with this guide, you now have all the basic knowledge about the custom clearance process.

We discussed the special checklist of documents required for import and export customs clearance, the method of clearing customs, and all the other essential details. If you still have any questions in your mind, ask us at AsianDavinci Sourcing.